Premarket gainers can offer a sneak peek into which stocks are poised for a strong day of trading. By focusing on premarket gainers, investors can identify trends before the broader market opens. Whether it’s a new product launch, an earnings report, or other significant news, these early movers often set the tone for the rest of the trading day.

Understanding the dynamics behind premarket gainers is crucial for making informed investment decisions. In this post, we’ll explore the top premarket gainers and what sets them apart, helping you stay ahead in the fast-paced world of stock trading. Dive into our analysis to see which stocks are showing promise and why.

What Are Premarket Gainers and Why Do They Matter?

Premarket gainers are stocks that show significant price increases before the stock market officially opens for trading. This early trading activity occurs in the premarket session, which typically runs from 4:00 AM to 9:30 AM Eastern Time. Stocks that gain during this time can provide valuable clues about their potential performance for the rest of the trading day.

Premarket gainers matter because they can signal early trends and investor sentiment. When a stock experiences substantial gains before the market opens, it often reflects positive news, strong earnings reports, or other significant developments that investors believe will influence the stock’s performance. These early movements can help traders and investors identify which stocks might perform well once the regular trading session begins.

Monitoring premarket gainers is essential for traders looking to get a head start on their investment strategies. By understanding which stocks are gaining in the premarket, investors can make more informed decisions and potentially capitalize on these early trends. The information from premarket gainers can help set up trading strategies, manage risk, and seize opportunities before the broader market reacts.

Top Premarket Gainers Today: A Comprehensive Review

Today’s top premarket gainers showcase stocks that have experienced notable price increases before the official market opening. Reviewing these stocks provides insight into which companies are attracting attention and why. For instance, some premarket gainers might be companies that recently reported strong earnings or announced new products, driving up investor interest.

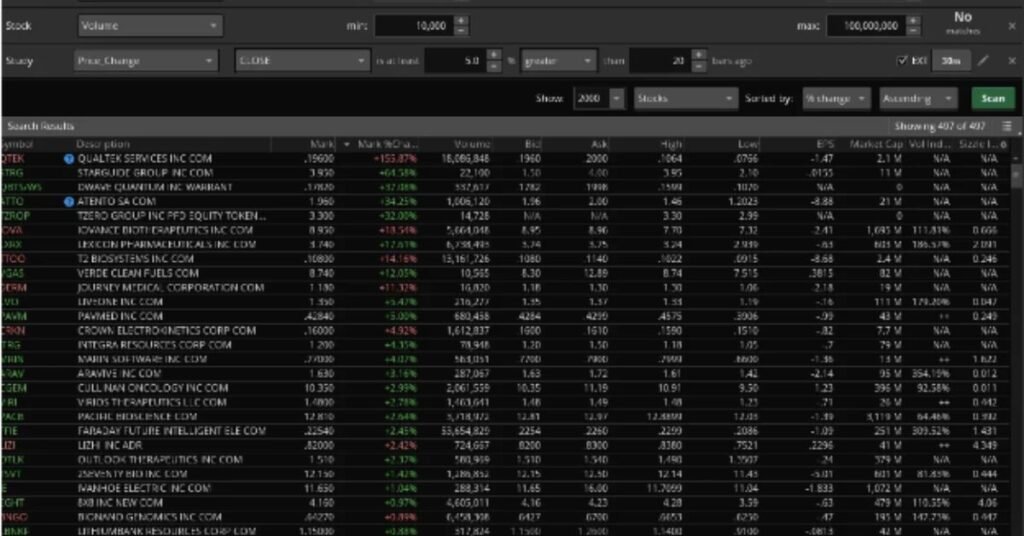

In this comprehensive review, we will analyze the leading premarket gainers of the day, highlighting the factors contributing to their early success. Key aspects to consider include the percentage increase in their stock prices, trading volume, and any relevant news or events impacting their performance. By examining these elements, you can better understand which stocks are poised for strong performance and why they are generating buzz in the premarket.

Staying informed about top premarket gainers allows investors to make strategic decisions based on the latest market trends. This analysis not only provides a snapshot of current market sentiment but also helps identify potential opportunities for profitable trades throughout the day.

How to Spot Premarket Gainers That Could Skyrocket

Spotting premarket gainers that have the potential to skyrocket involves a combination of technical analysis and market research. Start by identifying stocks that show significant price movements and high trading volume in the premarket session. These indicators often suggest strong investor interest and the possibility of continued gains as the market opens.

Look for stocks with positive news or earnings reports. A company that announces better-than-expected earnings or major product breakthroughs is more likely to experience substantial premarket gains. Additionally, consider the stock’s historical performance and volatility. Stocks with a track record of reacting strongly to news or market conditions may have a higher chance of significant gains.

Analyzing market trends and sector performance can also help in spotting potential winners. Stocks that align with broader market trends or sector-specific news are more likely to continue their upward trajectory. By combining these factors, you can increase your chances of identifying premarket gainers that have the potential to skyrocket.

Factors Influencing Premarket Gainers: Insights and Trends

Several factors influence which stocks become premarket gainers. Key among these are company-specific news and announcements. Positive developments such as strong earnings reports, new product launches, or strategic partnerships can drive a stock’s premarket performance. Investors react quickly to such news, often leading to significant early gains.

Market conditions and economic indicators also play a crucial role. Economic data, such as employment figures or interest rate changes, can impact investor sentiment and influence premarket trading. Additionally, broader market trends and sector performance can affect individual stocks, with some sectors experiencing more pronounced gains during certain economic conditions.

Understanding these factors provides valuable insights into premarket movements. By analyzing the impact of company news, economic indicators, and market trends, investors can better anticipate which stocks are likely to be premarket gainers and adjust their strategies accordingly.

Strategies for Leveraging Premarket Gainers for Investment Success

To effectively leverage premarket gainers, start by developing a clear strategy for monitoring and analyzing premarket activity. Use tools and platforms that provide real-time premarket data, including stock price movements, trading volume, and relevant news. Setting up alerts for significant premarket changes can help you stay informed and act quickly.

Incorporate premarket gainers into your investment strategy by setting specific criteria for entry and exit points. Determine how much you are willing to invest and at what price levels you will buy or sell based on premarket trends. This approach helps manage risk and maximize potential returns.

Additionally, use premarket data as part of a broader investment strategy. Combine insights from premarket gainers with fundamental and technical analysis to make well-rounded investment decisions. Regularly review and adjust your strategy based on market conditions and performance to optimize your investment approach.

Premarket Gainers: Key Indicators to Watch for Early Success

Premarket gainers are stocks that show notable price increases before the official market opens. To spot these potential winners, focus on a few key indicators. Firstly, trading volume is crucial. High premarket volume often signifies that a stock is experiencing significant interest, which can be a strong indicator of continued movement once the market opens. Additionally, look for substantial price changes in the premarket. A stock with a sharp rise or fall before the market opens is often experiencing a reaction to new information or market conditions.

Another important factor to consider is the stock’s volatility. Stocks with high volatility may experience more pronounced premarket gains, but they also come with increased risk. Therefore, understanding a stock’s volatility can help you gauge whether its premarket movement is likely to continue. Additionally, check the company’s recent news or announcements. Earnings reports, product launches, or major corporate news can drive premarket gains as investors react to these updates. By keeping an eye on these indicators, you can better assess which premarket gainers might offer the best opportunities for success.

Overall, monitoring these key indicators helps you identify promising premarket gainers. By focusing on trading volume, price changes, volatility, and recent news, you can make more informed investment decisions and capitalize on early trading opportunities.

The Role of News in Shaping Premarket Gainers

News plays a significant role in shaping premarket gainers. When a company releases important news, such as earnings reports, product launches, or significant corporate announcements, it can have a major impact on its stock price before the market opens. Positive news often leads to premarket gains as investors react quickly to the new information. For instance, a company reporting better-than-expected earnings might see its stock rise sharply in premarket trading as traders anticipate strong performance throughout the day.

In addition to company-specific news, broader economic news can also influence premarket gainers. Economic data releases, such as employment reports or changes in interest rates, can affect investor sentiment and impact multiple stocks. For example, positive economic news may boost market confidence and drive up the prices of various stocks, leading to a surge in premarket gainers.

Monitoring news sources and staying updated on both company-specific and broader economic news can help you understand the factors driving premarket movements. By analyzing how news events influence premarket gainers, you can make more informed trading decisions and capitalize on opportunities created by new information.

Understanding the role of news in shaping premarket gainers allows you to anticipate market reactions and identify stocks with potential for significant price movement.

Analyzing Premarket Gainers: What Traders Need to Know

When analyzing premarket gainers, traders need to consider several key factors to understand why a stock is experiencing significant movement. Start by examining the stock’s trading volume. High premarket volume often indicates strong investor interest and can signal potential for continued movement once the market opens. A stock with unusually high volume may be experiencing heightened attention due to recent news or developments.

Next, review the stock’s price changes during the premarket session. Significant price increases or decreases can be a sign of volatility or market reaction to new information. Combine this with an analysis of recent news or announcements related to the stock. Earnings reports, new product releases, or other significant updates can drive premarket gains as investors react to the news.

It’s also important to assess the stock’s overall market position and recent performance. Stocks with strong fundamentals and positive recent performance are more likely to maintain their gains. Look at the company’s financial health, market trends, and competitive position to gauge the sustainability of the premarket gains.

By analyzing these factors—trading volume, price changes, recent news, and overall market position—traders can better understand which premarket gainers are worth watching and which may offer potential investment opportunities.

From Premarket Gainers to Market Leaders: How to Spot the Winners

Identifying premarket gainers that have the potential to become market leaders involves a detailed analysis of several factors. Begin by looking at the consistency of the premarket gains. Stocks that show strong and sustained premarket performance may be more likely to continue their upward trajectory once the market opens. Assess whether the premarket gains are supported by positive news or strong earnings reports, as these can provide a foundation for future success.

Evaluate the stock’s overall market performance and fundamentals. Stocks that are not only gaining in the premarket but also have strong financial health and positive market trends are more likely to become market leaders. Consider the company’s earnings history, revenue growth, and competitive advantages. Stocks with robust fundamentals are better positioned to maintain and build on their premarket gains.

Additionally, observe the stock’s behavior during regular trading hours. Stocks that continue to perform well after the market opens and exhibit strong trading volume are more likely to become market leaders. By combining insights from premarket performance with a thorough evaluation of the stock’s fundamentals and market behavior, you can identify which premarket gainers have the potential to become leading performers in the market.

Top Strategies for Investing in Premarket Gainers

Investing in premarket gainers requires a well-defined strategy to maximize potential returns. Start by closely monitoring premarket trading activity to identify stocks with significant gains. Use tools and resources to track premarket volume and price changes, which can help you spot potential opportunities early. Setting up alerts for premarket movements can ensure you don’t miss key opportunities.

Develop a strategy that includes clear entry and exit points based on premarket data. Decide in advance how much you are willing to invest and at what price levels you will buy or sell. This approach helps manage risk and avoid making impulsive decisions based on premarket fluctuations alone.

Incorporate risk management techniques into your strategy. Since premarket trading can be volatile, consider using stop-loss orders to protect your investments from unexpected reversals. Regularly review and adjust your strategy based on market conditions and the performance of your investments.

By following these strategies and staying informed about premarket trends, you can improve your chances of successful investing and better capitalize on opportunities presented by premarket gainers.

Conclusion

Premarket gainers give us a sneak peek at which stocks might do well before the stock market officially opens. By watching these early movers, you can spot which companies are getting a lot of attention and why. This early information helps you make smarter choices about where to invest and what to expect during the trading day.

Understanding and using premarket gainers can make a big difference in your investing success. By keeping an eye on the key indicators and news, you can find opportunities and act quickly. So, next time you see a stock making big gains in the premarket, remember it might be a sign of something exciting to come!

FAQs

Q: What are premarket gainers?

A: Premarket gainers are stocks that show significant price increases before the stock market opens for the day. These gains occur during the premarket trading session.

Q: Why should I watch premarket gainers?

A: Watching premarket gainers helps you identify which stocks are experiencing early interest and could perform well during the trading day. It gives you a head start on market trends.

Q: How can I find premarket gainers?

A: You can find premarket gainers using financial news websites, stock market apps, or trading platforms that provide real-time premarket data and stock movements.

Q: What factors drive premarket gains?

A: Premarket gains can be driven by positive news, earnings reports, new product announcements, or overall market conditions that influence investor sentiment.

Q: Are premarket gains reliable indicators of daily performance?

A: While premarket gains can indicate strong early interest, they are not always reliable predictors of a stock’s performance throughout the day. Market conditions can change quickly.

Q: How can I use premarket data for trading?

A: Use premarket data to identify stocks with strong early performance. Set entry and exit points based on this data and combine it with other analyses to make informed trading decisions.

Q: What are the risks of trading premarket gainers?

A: Trading premarket gainers can be risky due to lower liquidity and higher volatility in premarket hours. Prices can fluctuate widely, so it’s important to manage risk carefully.